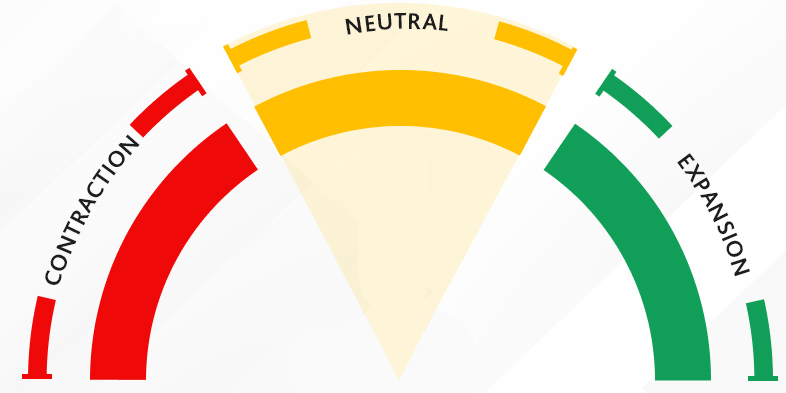

Moody’s Analytics Credit Cycle Index

The Credit Cycle Index combines five key indicators that tell us information about the current state of the credit cycle: (1) the recession probability, (2) the average one-year ahead probability of default, (3) the average spread of Baa rated bonds over the 10-year Treasury, (4) the volume of debt issuance, and (5) changes in the ratings of Moody’s-rated bonds. Learn more

| Indicator | Direction | Latest | 1M Change | 12M Change |

|---|---|---|---|---|

| Recesion Probability | Contracting | 69.5% | 127.4% | 231466.7% |

| Average PD | Netural | 6.4% | 7.9% | 47.7% |

| Baa Bond Spread | Netural | 218 bps | 5.5% | 15.3% |

| Isuance | Contracting | USD 95 billion | 11.8% | -22.7% |

| Rating Drift | Netural | 8% | -17.1% | 6.6% |

The business cycle and the credit cycle are closely linked. Factors like consumer confidence, the unemployment rate, and bank credit availability clearly affect the direction of the credit cycle. Moody’s Analytics Recession Probability predicts the likelihood of the economy falling into recession in the next 12 months. Recession is defined as two consecutive quarters of negative GDP growth. The Recession Probability model is based on 6 macroeconomic and 6 financial market variables. Learn more

Corporate default rates rise as the economy slows, and increase sharply in a recession. The average PD of companies is a direct, forward-looking gauge of the credit health of the economy. PDs measure the likelihood that a firm will default on debts due in the next 12 months. The average PD summarizes the risk of all publicly listed firms in the economy. Learn more

The corporate bond spread is the premium over the risk-free rate investors demand to compensate for taking credit risk. When credit risk increases, the spread widens, and vice-versa. The Baa bond spread measures Moody’s Seasoned Baa Corporate Bond Yield relative to yield on 10-Year constant maturity Treasuries, express in basis points.

Corporate debt issuance tracks the change in the credit cycle. When credit risk and spreads are low, liquidity provided to companies by the market is ample. When credit conditions tighten, corporate debt issuance slows. The chart shows monthly USD volume of corporate debt issuance, with the 6-month moving average to smooth out variation over time.

Changes in credit ratings assigned by Moody’s Investors service are historically a good contemporaneous indicator of the credit cycle: when there are more downgrades than upgrades of debt issuers, the credit cycle is in a contractionary.